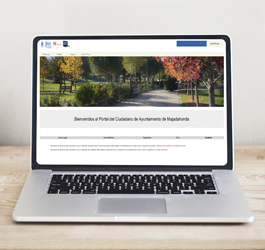

Portal web del Ayuntamiento de Majadahonda - Ayuntamiento de Majadahonda

Comunicación

Noticias

03·07·2025

Vuelve “Este verano, Chapuzón Seguro”, una iniciativa del Ayuntamiento de Majadahonda para prevenir ahogamientos y accidentes en las piscinas Protegerse del sol durante las horas centrales del día, no correr alrededor de la piscina o no tirarse de cabeza en zonas poco profundas, son...

02·07·2025

El Ayuntamiento de Majadahonda relanza “Vacaciones Seguras” para custodiar las llaves de viviendas y negocios durante el verano La Policía Local guardará las llaves de los vecinos que se inscriban en el programa y las usará para acceder a las viviendas y negocios solo en el...

02·07·2025

Majadahonda busca talento musical joven para sus Fiestas Patronales 2025 El plazo de inscripción para el concierto joven, que se celebrará el próximo 17 de septiembre, se ha prorrogado hasta el 6 de julio. Entre los...

Ayuntamiento

Servicios Municipales

Te interesa

Sede Electrónica

Transparencia