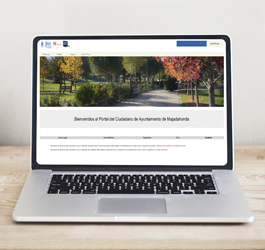

Portal web del Ayuntamiento de Majadahonda - Ayuntamiento de Majadahonda

Comunicación

Noticias

15·07·2025

¿Quieres ser una de las nuevas voces del Coro Joven de la Escuela de Música de Majadahonda? Apúntate a las audiciones Las audiciones se celebrarán en septiembre y podrán participar en ellas los jóvenes de entre 14 y 25 años que se inscriban previamente. No es...

14·07·2025

Majadahonda aprueba una bonificación del 10% en la Tasa de Residuos para familias monoparentales La ciudad se convierte en una de las primeras en España en implementar una medida que equipara, en términos de beneficios fiscales, a las familias...

08·07·2025

El Ayuntamiento destina este verano 350.000€ para mejorar las instalaciones y accesibilidad de los colegios de Majadahonda En total hay previstas, 68 actuaciones durante los meses de descanso vacacional, estando ya en ejecución o finalizadas alrededor del 50% de las...

Ayuntamiento

Servicios Municipales

Te interesa

Sede Electrónica

Transparencia